In the ever-changing landscape of high-end markets, India is evolving into an alluring destination for foreign brands in search of new frontiers. With China’s economic expansion showing signs of slowing down, India’s stable and steady growth is presenting an enticing opportunity for luxury manufacturers and retailers. In this article, we explore how India’s luxury market is transforming into a magnetic force for foreign labels.

A Prosperous Scenario

India’s luxury market is witnessing a surge in interest from global brands keen on tapping into its potential. Recent market entries and collaborations underscore this trend. Swiss luxury chocolatier Laderach has inaugurated its first boutique at the upscale DLF Emporio Mall in New Delhi. French luxury retailer Galeries Lafayette is poised to establish a presence in India through a partnership with the Aditya Birla Group. Balenciaga SA, the Spanish luxury fashion house, is gearing up to open stores in collaboration with Reliance Brands. TimeVallee, a Swiss luxury multi-brand watch and jewelry boutique, and Dutch haircare salon services brand Keune are among the newcomers making their debut.

Elias Laderach, a prominent figure on Laderach’s executive board and the company’s chief creative officer, expressed a strong belief in the tremendous opportunities offered by the Indian market for luxury brands. He conveyed his optimism, particularly regarding major Indian cities and the consumer base. In collaboration with DS Group, Laderach has laid out plans to establish multiple physical retail outlets in India, while also expanding their online presence through e-commerce.

Factors Driving India’s Luxury Market Growth

- Projections and Potential: India’s luxury market is poised for rapid growth, with a projected value of $8.5 billion in 2023, up by $2.5 billion from 2021. Furthermore, a Bain & Co. report suggests that by 2030, the Indian luxury market could reach an astounding $200 billion.

- Economic Momentum: India is expected to be the world’s fastest-growing economy over the next decade, fueled by robust domestic demand, well-developed physical and digital infrastructure, and increased global competitiveness. While many major economies grapple with recessionary trends, India’s economy is set to grow by approximately 70% in a year, propelling it to become the fifth-largest economy globally.

- Wealth Distribution: Mumbai leads the pack in India, boasting 59,400 high-net-worth individuals (HNWIs), making it the 21st wealthiest city worldwide. Delhi follows closely behind, ranking 36th globally with 30,200 HNWIs. Notably, Bengaluru, Kolkata, and Hyderabad are emerging as significant markets with their substantial HNWI populations.

- Rising Ultra-High-Net-Worth Individuals (UHNWIs): India is witnessing a remarkable increase in UHNWIs, individuals with net assets of USD 30 million or more. This segment, along with a growing middle class, expanded e-commerce penetration, and demand from tier 2 and 3 cities, contributes to the bullish outlook for the luxury market.

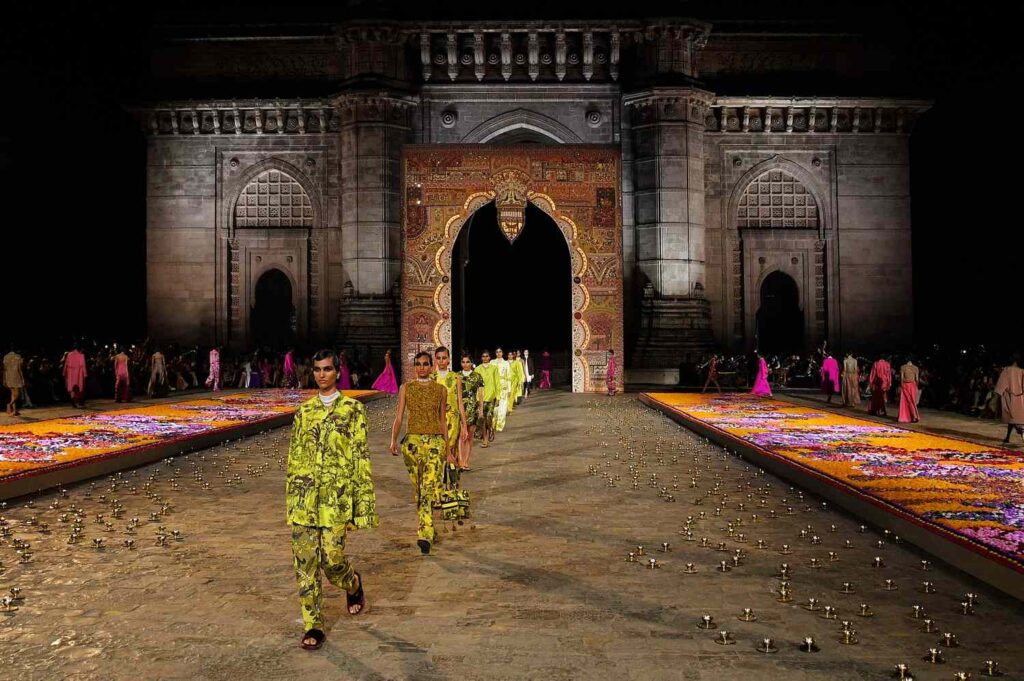

- Luxury Brand Presence: Delhi and Mumbai have historically competed for the title of India’s luxury fashion capital. International luxury brands have recognized the potential of India’s booming consumer market. Recent moves include fashion house Christian Dior Couture showcasing its Fall 2023 collection in Mumbai and luxury brands like Louis Vuitton, Dior, Chanel, and Hermès expanding their presence.

- Untapped Markets: As India becomes the most populous country globally and the fifth-largest economy, luxury brands are exploring opportunities beyond Delhi and Mumbai. Brands are looking to tap into cities like Bengaluru, Kolkata, and Hyderabad, recognizing their potential for attracting local luxury consumers.

- Diversification and Innovation: Luxury brands are diversifying their offerings in India, introducing products inspired by Indian culture and preferences. For example, Dior unveiled its Fall 2023 collection in Mumbai, reflecting a rising interest in tapping India’s growing wealth.

- Luxury Retail Infrastructure: Delhi and Mumbai have dedicated luxury retail infrastructure, making them attractive options for international labels. Malls like DLF’s Emporio and Chanakya Malls in Delhi and Palladium Mall and Jio World Plaza in Mumbai provide ideal environments for luxury brands to thrive.

- Strategic Partnerships: Aditya Birla Fashion Retail (ABFRL) has joined forces with French luxury retailer Galeries Lafayette to establish stores in India, offering over 200 prestigious brands such as Armani, Christian Dior, and Prada. This partnership has been hailed as a “coming-of-age moment for Indian luxury,” further enhancing the presence of renowned international luxury brands in the Indian market.

- Tailored Offerings: Global luxury brands are customizing their products and marketing campaigns to cater specifically to the Indian market. For instance, Louis Vuitton introduced a Rani Pink line, Dior held a high-profile fashion show in Mumbai, and Bvlgari launched the mangalsutra, a traditional Indian necklace. This adaptability to local preferences is strengthening the appeal of luxury brands among Indian consumers.

A Wealth of Opportunities

According to the Credit Suisse Global Wealth Report, the number of millionaires in India is projected to double from 796,000 in 2021 to 1.6 million by 2026. This increasing affluence is drawing luxury brands from various sectors. For instance, Dutch luxury hair cosmetics company Keune recently entered India through a distribution and marketing partnership with Indian beauty company Maison D’ Auraine. Eelco Keune, the CEO, highlighted India’s vibrant market and the growing post-pandemic demand for grooming.

As luxury brands expand their footprint in India, they are diversifying their product portfolios. Michael Kors, for instance, has expanded to operate seven stores, while platforms like AJIO Luxe, Tata CliQ, and Collective have broadened their offerings to include brands such as Self Portrait and Cult Gaia. The arrival of retailers like Elle Decor and Pottery Barn signals the emergence of new categories, including home decor.

Tata CLiQ Luxury, in collaboration with TimeVallee, has launched a digital boutique in India, showcasing timepieces from renowned brands like Cartier, IWC Schaffhausen, Jaeger-LeCoultre, Panerai, Piaget, and Roger Dubuis.

In conclusion, India’s luxury market is undergoing a transformative shift, attracting global brands eager to capitalize on its growth prospects. As India’s affluence continues to rise, luxury brands are adapting to cater to the diverse preferences of Indian consumers. The luxury market in India is not just thriving; it’s experiencing a remarkable evolution that promises opportunities for both brands and consumers alike.

Do you have a question about strategizing your business move to India or integrating your existing business more into the Indian market, please get in touch with us here or email us at monika@nyasa.solutions.

Image: InStyle